Homeownership Programs

- You must not have owned a home within the last three years (including a manufactured home on a permanent foundation).

- You must meet income and purchase price limits.

To qualify, one of the following must describe the households:

- The mortgagor must be a single-parent with at least one dependent child residing in the home 50 percent of the time.

- The mortgagor or the mortgagor’s spouse must have served in the active military, naval or air service and been discharged or released from active duty under conditions other than dishonorable.

- The mortgagor, mortgagor’s spouse or a dependent(s) must be permanently disabled or age 65 or older and reside in the home.

- You must meet income and purchase price limits.

- The maximum Roots loan amount must comply with the current Fannie Mae/Freddie Mac conforming loan amount or the limits of the applicable loan insurer/guarantor. There are no income or purchase price limits.

- Refinances are allowed. Start not available for refinances.

The Internal Revenue Code requires that NDHFA, as an issuer of tax-exempt mortgage revenue bonds, set aside a portion of the proceeds of a bond issue for up to one year for reduced interest rate mortgage loans in Targeted Areas of North Dakota.

To determine if a home is in a Targeted Area, search by the address. Type in the address of the property, click search and the corresponding census tract will appear in the information listed. To qualify, the Census Tract number must match one of the tract numbers identified below.

Cass Census Tracts 0005.02,0006.01,0006.02, 0101.06, 0101.07, 0101.11

Sioux Census Tract 9409

- You must meet income and purchase price limits.

Through the DCA program, NDHFA provides low-income buyers with affordable mortgage loans that include down payment and closing cost assistance. Amount of assistance equals three percent of the first mortgage loan amount in the form of a credit towards your out-of-pocket cash requirement. This can be used for downpayment, closing costs and prepaid items.

DCA cannot be used in conjunction with any other down payment assistance programs.

- You must meet income limits, which vary based on county and family size.

- Only one to two-unit properties (one unit must be occupied by borrower).

- You must complete a homebuyer education course and receive a certificate of completion that is dated before loan closing.

Through the Start Program, NDHFA provides low- to moderate-income buyers with affordable mortgage loans that include down payment and closing cost assistance. Amount of assistance equals three percent of the first mortgage loan amount in the form of a credit towards your out-of-pocket cash requirement. This can be used for downpayment, closing costs and prepaid items.

- Start cannot be used in conjunction with any other down payment assistance programs.

- Start can only be used on one to two-unit properties (one unit must be occupied by borrower).

Lender Training

Lender Training classes are targeted to Participating Lenders, financial institutions that originate loans on the agency’s behalf. Loan officers, processors, closers and other pertinent staff will benefit from the sessions.

There are no lender trainings scheduled at this time.

Marketing Materials

NDHFA offers marketing materials for participating lenders to promote our programs to your borrowers and housing industry partners. Flyers can be customized by adding your name, contact information, photo and logo.

The following social media graphics have been provided for you to use and customize with your own company logo.

Remember to remove your logo or image after downloading the graphics.

On-demand Training Using EdApp

Through EdApp, North Dakota Housing Finance Agency’s (NDHFA) Participating Lenders can complete on-demand training for the FirstHome™, HomeAccess and North Dakota Roots mortgage loan programs, and the Start and DCA purchase assistance programs.

EdApp courses can be accessed on a computer, or from a tablet or cell phone.

Computer Access:

- Go to EdApp.com, https://link.edapp.com/eT5M3QQSMmb

- Create an account.

- Scroll down to select your first course.

Tablet or Cell Phone:

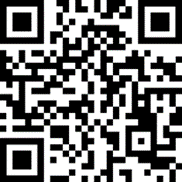

- Download EdApp in the Apple or Google Play store or scan the QR code on the right.

- Create an account.

- Scroll down to select your first course.

How it works:

- You will begin with an Introduction to NDHFA and our Start and DCA purchase assistance programs, and then move through lessons for the FirstHome, HomeAccess and North Dakota Roots programs.

- Each EdApp lesson provides detailed information and incorporates dynamic visuals and fun quizzes to help you learn about the programs and to help you retain the information.

- While EdApp courses replaced the training videos that were available on NDHFA’s website, they will not replace our face-to-face training. The agency plans to continue hosting in-person trainings on our homeownership programs.

Questions:

If you experience any issues logging into or navigating EdApp, contact our communications staff at hfacomms@nd.gov or 800-292-8621.