In the late 1970s and early 1980s, the U.S. economy was in a deep recession. To combat inflation, the Federal Reserve was increasing interest rates, which ultimately pushed mortgage rates over 18 percent.

On March 10, 1980, Gov. Art Link established a special task force to explore financing that would make housing more affordable in North Dakota. The task force brought forth an initiated measure that would allow the state to offer tax-exempt financing. On Nov. 4, 1980, the concept was put in the hands of the people. North Dakotans voted yes, spurring the creation of a housing finance agency.

Initially Bank of North Dakota was charged with acting as the state’s housing finance agency. Finally, on Feb. 4, 1982, North Dakota Housing Finance Agency (NDHFA) became a standalone state agency. Later that summer, NDHFA executed its first single and multifamily housing bond purchase contracts.

Over the past four decades, more than 47,000 individuals and families have benefited from the tax-exempt financing that was approved by North Dakota voters and still offered by NDHFA today. Most of those households are first-time homebuyers.

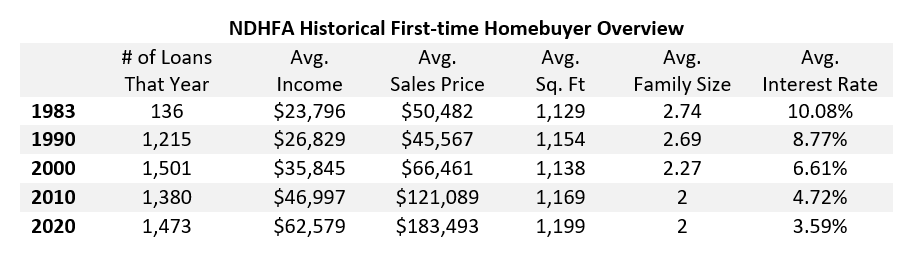

The chart below illustrates the use of NDHFA’s FirstHome program. Since the first loans were purchased, interest rates have dropped dramatically and the number of people living in the home at the time of the purchase has trended downward as well. Most interesting is that while the size of the home has only increased 6 percent, average household income is up 163 percent and the purchase price of the home is up 263 percent.

Today, more than 75 percent of NDHFA’s borrowers receive purchase assistance – first-time buyers, special needs households, and households who just need help to buy again. Receiving down payment and closing cost assistance helps buyers achieve homeownership sooner and it frees up their available funds for necessities like home improvements and the purchase of their first lawn mower.One of the greatest hurdles first-time homebuyers face is covering down payment and loan closing costs. Through a grant from the Federal Home Loan Bank, NDHFA first offered purchase assistance to lower-income borrowers in 1990. The homeownership division began offering down payment and closing cost assistance to all the agency’s first-time homebuyers in 1997.

To ensure the best customer service possible, NDHFA began servicing its own loans in 1991. The majority of the more than 11,000 loans in NDHFA’s portfolio today are its own. The agency also services loans for the Bank of North Dakota and for local nonprofit housing providers, helping the latter increase their lending capacity. Keeping NDHFA’s servicing local makes life easier and contributes to the success of the agency’s homeowners.

While I only focused on the agency’s first-time homebuyers program, I encourage you to visit our history webpage www.ndhfa.org/index.php/history/ to see how the agency has been actively involved in all aspect of affordable housing.

Finally, I want to thank all our housing partners who have evolved and grown with us to shape the many programs that help to ensure the availability of affordable housing for every North Dakotan.

john wagner

Truly a great success story, and a classic case of a highly successful quasi-governmental organization. And a real compliment to the leadership (past and present) of NDHFA.

John Wagner

Terry Hanson

Congratulations NDHFA. A great example of foresight and leadership.