Housing Incentive Fund

State-Funded Financing

The Housing Incentive Fund (HIF) is a state-funded gap financing program used with federal and private dollars to create affordable multifamily housing in urban and rural communities. The North Dakota Housing Finance Agency (NDHFA) administers the program on behalf of the state of North Dakota. Leveraged as an upfront, one-time investment, HIF ensures rental homes in the supported projects will be affordable for a minimum of 15 years.

The North Dakota Legislative Assembly created HIF in 2011 to address workforce housing needs in western North Dakota. The program has evolved over the past decade into a flexible funding resource to construct and rehabilitate multifamily housing in communities across the state. Funding is dependent upon legislative approval.

Currently, no HIF funding is available.

Each Community Has Unique Housing Needs

North Dakota communities have unique needs that vary based on economic growth, job openings and unemployment rates, demographic trends, and availability and affordability of existing housing.

On average, 37 percent of North Dakota’s residents or 108,224 individuals and families live in multifamily housing. Annually, 39 percent of all renters, more than 42,000 people, cannot afford to pay their housing costs and are considered to be housing cost-burden.[i] More than half of these renters, 26,485, are considered to be extremely low income (ELI), earning less than $27,000 annually for a family of four.

While the average renter earns $17.12 an hour and can afford the state’s average fair market rate (FMR) rent for a two-bedroom apartment at $841, wages and rents vary significantly from community to community. Learn more about fair market rent in a specific community.

North Dakota’s diverse economy supports the construction of new market-rate multifamily housing. As of Sept. 1, 2020, the state’s average vacancy rate was 9.4 percent. However, a robust private market cannot financially create the affordable housing rents needed by lower-income and ELI individuals and families.

Learn more about statewide affordable housing needs in the 2020 study: The Current State of Housing in North Dakota.

[i] The US Dept. of Housing and Urban Development defines housing cost-burden as paying more than 30 percent of an income on housing costs.

Reality of Earning Minimum Wage

Flexible Gap Funding Resource

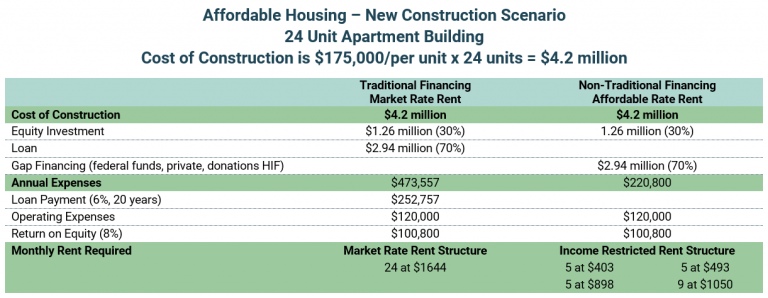

HIF is a flexible gap funding resource that can reduce the amount of financing debt for new construction multifamily housing. The following chart is an example of financing for private-market housing compared to affordable housing.

HIF Helps Communities Thrive

The state of North Dakota’s 10-year investment in HIF has resulted in 84 unique projects and 2,704 affordable rental homes. Each project has a complex funding portfolio, multiple funding sources is not unusual including the use of federal funds, private equity, loans, endowments, grants and donations. On average HIF covers 20 percent of the gap financing needed to move a project forward.

HIF Across North Dakota

Every $1 of HIF funding invested has resulted in an additional $4.93 leveraged. While the primary goal is to create and preserve affordable housing, the secondary benefits of HIF projects include prioritizing community infill and the creation of multiuse buildings where a business(es) rents space that help cover financing costs.

The program has supported the redevelopment of a middle school, nursing home, convent, deteriorating public housing and a hospital.

The map shows of all of the affordable multifamily housing projects that have used HIF funding.

Every $1 of HIF funding invested has resulted in an additional $4.93 leveraged.

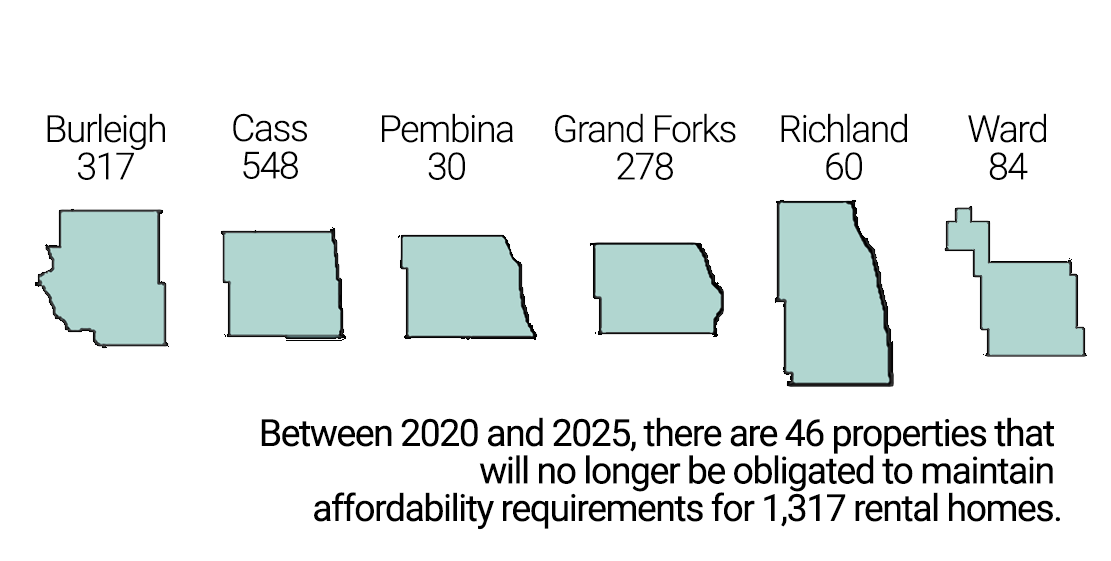

Risk of Losing Affordable Multifamily Housing

HIF is a solution for older, affordable multifamily properties to finance rehabilitation of the apartments and continue to secure affordable rents for an additional 20 years. There are properties across the state that used federal Low Income Housing Tax Credit funding with limited-term requirements during which they must remain affordable. The low-income housing tax credit (LIHTC) program is one such program that permits the affordability to expire after a certain period of time – typically 30 years or more. Between 2020 and 2025, there are 46 properties that will no longer be obligated to maintain affordability requirements for 1,317 rental homes. These properties are 30-years old, however, losing the affordability component will be devastating to the individuals and families living there, and to the communities.

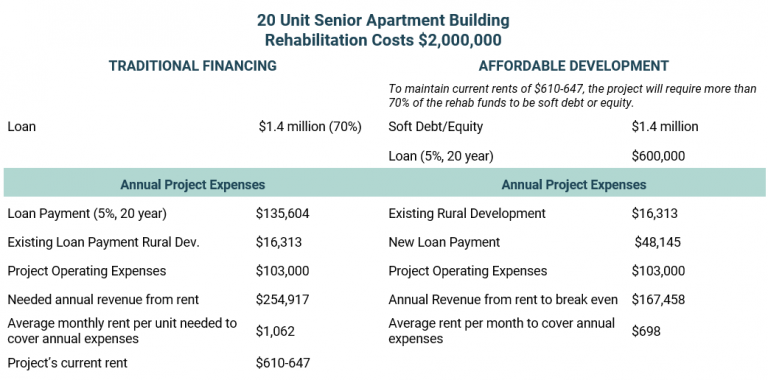

Rehabilitating existing multifamily housing or repurposing existing buildings is challenging. HIF is a flexible gap financing resource that can be used to buy down the financing debt. The following chart is an example of traditional financing compared to affordable development.

Who Lives in HIF Funded Affordable Multifamily Housing?

Anyone can live in HIF funded multifamily housing as long as they meet certain income requirements. Some properties have a specific population such as persons over the age of 65, the chronically homeless or survivors of domestic violence. You can learn more about the various properties and the people here.

When assessing which North Dakotans have the greatest barriers to accessing affordable housing, NDHFA works with stakeholders, reviews public comments, and analyzes data trends. These decisions are critical as state, private and federal funding is extremely limited and never enough to meet community housing needs. HIF has been used to develop housing for specific populations including Seniors, Individuals who are Homeless/Chronically Homeless, and the Lower-Wage Workforce.

Seniors

Ages 75 -85

$35,900

annual median income

76.1%

homeownership rate

15.3%

two or more disabilities

$898

affordable monthly rent

Ages 85+

$19,700

annual median income

62.8%

homeownership rate

50.1%

two or more disabilities

$492

affordable monthly rent

Social Security Income

$16,133

annual median income

$403

affordable monthly rent

29,057

rely on social security for 90% or more of their income

Homeless/Chronically Homeless

$30,000 – $50,000

annual cost per chronically homeless person

75.5

average chronically homeless population

1,102

average homeless population

26,964

living in extreme poverty

2,658

homeless youth in the public school system

4,482

individuals experiencing homelessness needed support in 2019

3.6%

have been homeless for more than 3 years

2,648

women and children domestic violence survivors needed emergency, transitional and short and long-term housing

Lower-Wage Workforce

Who is experiencing a housing cost burden?

42,000

renters

28.7%

Native Americans

33.4%

people of color

Below the Poverty Level Socioeconomics

6.5%

of working adults (16-64)

29.2%

non-working adults (16-64)

32.6%

single women with children

17.7%

have one or more disabilities

Everyone Deserves a Safe and Affordable Place to Call Home

HIF expands the ability of diversified affordable multifamily housing in urban and rural communities.

(click on the photos below to learn more)